The answer to this is Yes. Shareholders of a Singapore company can be any of the following:

- A resident individual ( e.g. Citizens, PR, Employment Pass Holders) ,

- A foreign national

- A local corporate entity (e.g. Sole Proprietorship, Partnership or a Pte Ltd) , or

- A foreign corporate entity.

A company can be owned and operated by a single person; i.e., a person can be the sole shareholder and director of a company. However the following conditions apply:

-

- In a one person company where the director and shareholder are the same person, it is mandatory that you appoint someone else (a local resident) as a company secretary. Generally this would apply to companies incorporated by resident individuals. These companies would usually work with a corporate services provider who will be able to assist in ensuring that a qualified person acts as your company secretary.

- For Foreign Nationals, you should also ensure that you have at least one director who is a Singapore Citizen or Permanent Resident. If you choose to appoint an Employment Pass Holder as your director, approvals from the authorities would have to be got. Hence please take note that as a foreign national who chooses not to be a resident of Singapore, you can still be the shareholder and operating director of your company. However you will be required to appoint a Singapore Resident as an additional director. This is where help from your corporate service provider will come into play and we will be able to offer you qualified local residents who will be able to act as your nominee director.

The legal requirements to register a company in Singapore are predominantly the same for Singaporeans and Foreign Nationals They are as follows:

- The company must appoint a qualified local company secretary,

- The company must appoint a local address as the registered business address for the company,

- The company must appoint a local resident director, and

- The company must have a minimum share capital of S$1.

A subsidiary company is just another term used for a locally registered company with corporate shareholding. Therefore the same requirements listed in the above question applies.

With the ease of technology and especially post Covid-19, we will be able to take care of all your incorporation needs online.

Please do note that currently most Singapore banks will require an in-person account opening. This has been eased somewhat with Covid-19 however whether its going to be a permanent norm remains to be seen. Generally most of our clients use the bank account opening as an excuse to visit Singapore and experience what it has to offer you first hand.

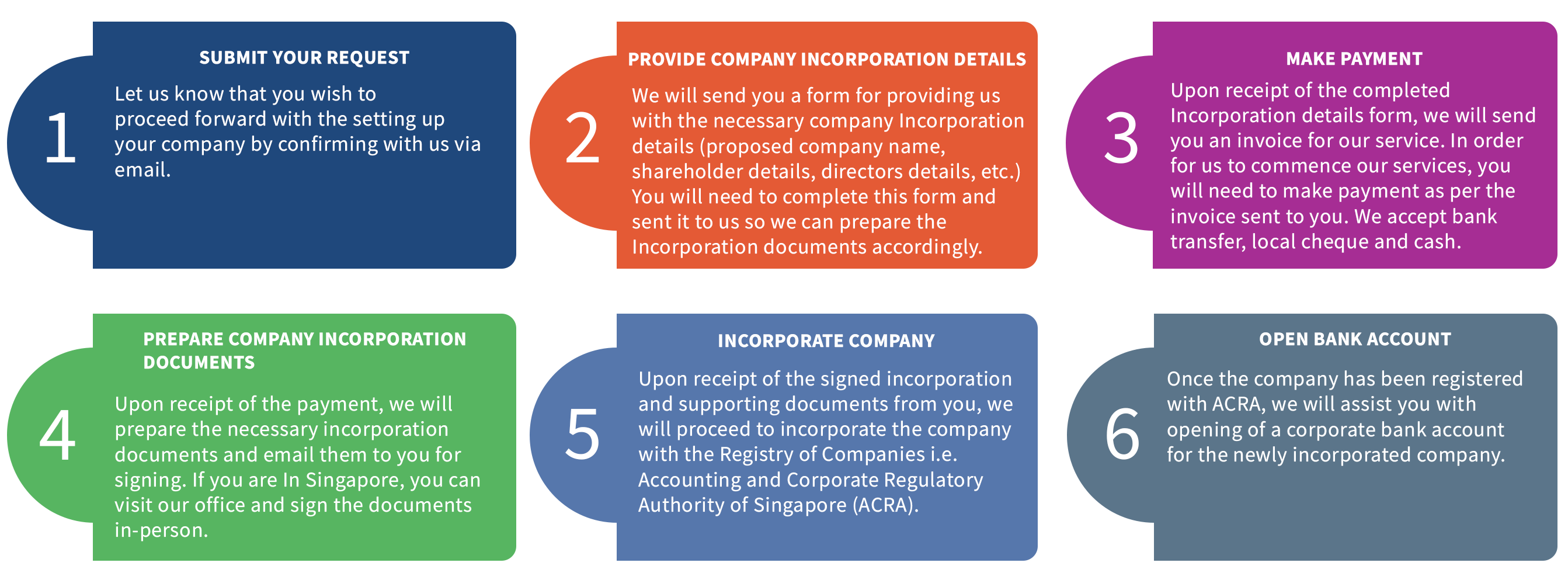

The procedure for incorporating a Singapore company with us is straightforward as described in this incorporation process flowchart

Singapore company registration consists of a number of steps and the typical timelines for each step has been listed below for your ease of understanding. Please keep in mind that some of these timelines are dependent on how quickly you can get the information required back to us.

- Providing information about company structure and supporting documents: This can take anywhere from a few hours a few days (depending on how long the client takes to get back to us)

- "Know Your Client" (KYC) checks by Corporate Service Provider as required by law: 1 day

- Reservation of Company Name with ACRA: Less than 1 hour to apply however could take up to a day to a week to approve (depending on whether the name requested is disputed).

- Preparation of the incorporation documents: Within 24hrs upon receipt of documents

- Client Review and Signatures on document set: This could take between 24hrs to a few days (depends on the client and number of signatories involved)

- Incorporation with ACRA: About 1hrs to incorporate and within 24hrs we should get the approval unless there are any further clarifications ACRA needs to get from us on your company.

Yes, each Singapore company must appoint a corporate secretary. A company secretary is an individual who is a resident of Singapore, who is knowledgeable about the Singapore Companies Act and that individual must also possess the requisite experience to fulfill the role of a company secretary.

Please take note that a person who is the sole-director of the company would be unable to act as the company secretary. For listed companies, the corporate secretary appointed should be certified through the Chartered Secretary Qualification (SAICA) course.

We will be able to appoint a local secretary as well as take care of all your regulatory filings in Singapore.

You can definitely work with us on our Nominee Director service offerings to satisfy this requirement. Please bear in mind that our Nominee Director and/or Corporate Secretary shall not be required to participate, in any manner whatsoever, in the management or decision-making of any End-Client company. They also shall not be required to sign or execute any agreement, assurance, guarantee or other documents which would incur or in any way impose any personal liability on the Nominee Director and/or the Corporate Secretary, whether as a principal or guarantor.

Unfortunately this is not possible. Singapore's corporate regulations state that you will be unable to register a company unless you provide details of the local director and registered address for the company. Therefore, you have to establish this information right at the onset.

There is no such requirement and you are more than welcome to remotely operate your Singapore Company. Please do keep in mind that should you decide to relocate you would have to get the necessary work visas that would allow you to live and work in Singapore.

Yes, you can fulfill the resident local director requirements after you have obtained a valid work visa. However there are many foreign nationals who continue to engage our nominee director services even after getting their work visas as they feel reassured that their directors ensure that all local filings are adhered to as a 2nd set of eyes.

In general:

- You must file an Annual Return with Singapore Company Registrar - ACRA.

- You must file an annual corporate income tax return with Singapore tax authority, IRAS.

Both of the above filings will be taken care of by us hence giving you the peace of mind.

Yes it is a very big deal and timely compliance is recommended. Please do understand that while the Singapore government makes the whole incorporation process a very pleasant experience for anyone looking to do business here, it does expect all companies to comply with its regulations. Serious penalties can apply in case of non-compliance.

Generally there are annual costs of maintaining your company which actually benefits you immensely as you can just focus on the growth of your business while leaving the non-core tasks to us.

The annual cost of corporate secretarial services, such as company secretary, registered address, and nominee local director and Accounting and tax filing services, such as bookkeeping, payroll, corporate tax filing will vary depending on the size of your business and the specific services you need.

You would only have to register for GST if your business turnover in the past 12 months (or in the next 12 months) exceeds S$1 million.

If you desire to incorporate GST, you are allowed to voluntarily register for GST at any time.

For most industries in Singapore, you do not have to obtain a license before commencing operations. However, certain industries does require you to have a license before commencing activities. Examples include employment agencies, financial services firms, travel agencies, restaurants. You can find more information here.

The Singapore government requires all corporate service providers to conduct "Know Your Client" (KYC) due diligence on every client before they register a company on behalf of the client. The KYC procedures are designed to comply with FATF's AML/CFT guidelines. This is to prevent shell companies from operating in Singapore.

Singapore is not on the OECD list and is definitely not considered a tax haven by any international organization. As a nation, we fully comply with OECD initiatives for preventing tax avoidance.

Singapore maintains a public register of all companies. The name, address, and ownership information of a company is available to the public through this register.

Yes, you can. However, as part of the AML/CFT regulations, Singapore's corporate regulations require the disclosure of all beneficial owners and controllers of a company are to be stored in a private register. This register is accessible only to law enforcement agencies and not to the general public.

UBO stands for Ultimate Beneficial Owner. This is a term that is defined as part of Singapore's Anti Money Laundering (AML) and Combating Financing of Terrorism (CFT) regulations. Singapore's corporate regulations require the disclosure of all beneficial owners of a company.

A UBO is an individual who benefits from the ownership of the company and has control over the company through voting power, but ultimately is not involved in the management of the company. Use of the terms "ultimately owns or controls" and "ultimate effective control" refer to situations in which the ownership or the control is not direct but is exercised through a chain of ownership or by means of control other than direct control.

Singapore provides one of the most welcoming environments for startups. Several tax benefits and cash grants are available to startups. Some examples include:

- Full tax exemption on the first S$100,000 of profits and 50% tax exemption on the next S$200,000 of profits for the first 3 years. Note that from Year of Assessment 2020 this incentive will be changed to 75% tax exemption for first S$100,000 of profits and 50% exemption on the next S$100,000 in profit for the first 3 years.

- A tax credit of up to 100% of the capital expenditure incurred for qualifying projects during the first five years (up to eight years in some cases).

- 400% tax deduction or allowance on expenditures that enhance productivity or innovation.

- Several cash grants available to startups in targeted industries.